The Reasons Startups Should Start with a Seed Round vs. Series A

Marketing Blog CONSULTATIONBLOG HOMEWhy Should a Startup Start with a Seed Round Instead of Diving Straight into a Series A?

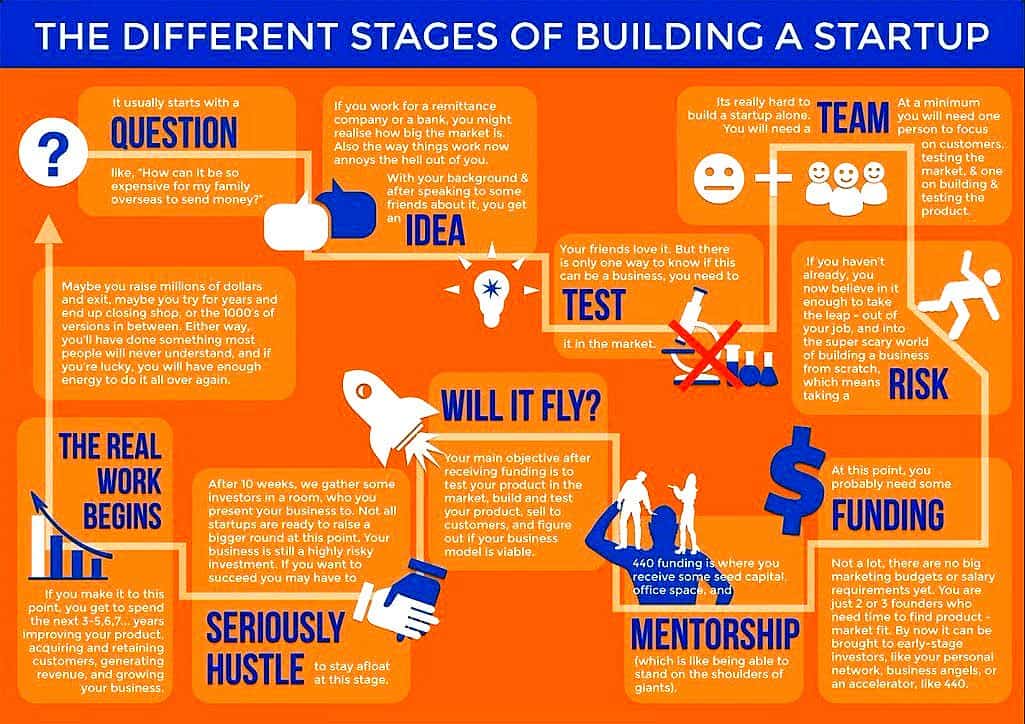

Raising capital for any entrepreneur and new startup venture is without the most difficult waters to navigate. In fact, funding a new venture is a challenge in itself. Do you go with a traditional loan, grant, continue to bootstrap, crowdfunding or rob the local bank? These are all questions that you as a founder need to assess – hopefully the last one is not an option.

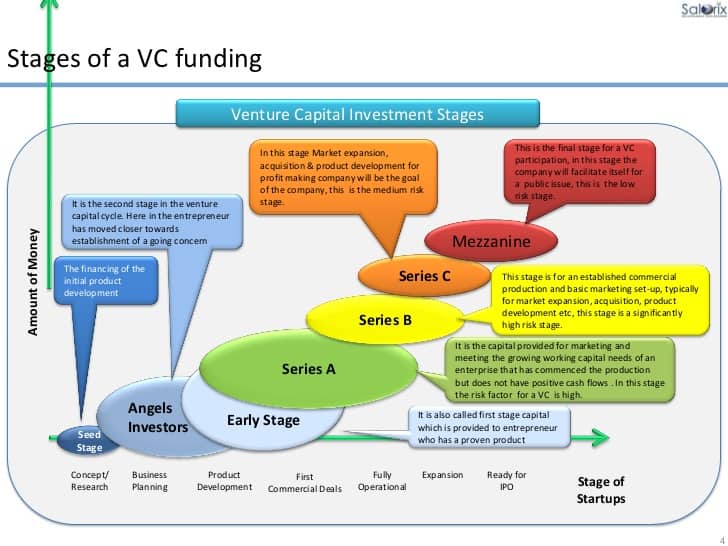

Without question, the best source of funding is venture capital. And in a few minutes of studying venture capital funding you will discover the series rounds. For many entrepreneurs, the Seed round is often forgotten. In this article we are going to dive into the reasons that the Seed round is the most crucial and why you should start with it.

Before you go into the article, we recommend you read our previous blog post on the top 15 Startup Pitch Decks to Emulate that show you the deck and the funding each startup captured.

The Saga of Raising Startup Capital

I find that exceptional entrepreneurs have the opportunity to “jump straight to A” rather than raise a seed round. That is, they’d bypass a traditional starting point of $750K – $2M from angels and seed funds and raise $3M+ primarily from one large venture capital investor. The rationale for doing this is obvious: You get a large capital partner involved early who is fully committed to your company. You also get more money earlier that you can use as a tool for leverage. After all, if only a minority of seed rounds (on average) result in a series A investment, why not take that risk out of the equation early and jump straight to A?

Why You Shouldn’t Skip Raising Seed

There are a few reasons NOT to jump over seed straight to Series A. Jumping straight to an A round may seem like a good idea, but you are giving up a few things that I think are pretty valuable and are offered by raising a typical seed round. Keep in mind that I’m a biased observer here since we are exclusively a seed-focused fund, and I think that is usually the best “product” for most entrepreneurs. But having said that, here are the four main reasons to raise a seed, even if you have the option of jumping straight to your series A.

1. Getting a Variety of Great People Involved

This is the point where that network you have been building for years finally pays off. Seed rounds tend to be composed of a larger number of participants, including both angel investors and institutional seed funds. Getting access to a breadth of networks and resources is pretty helpful in the early stages of a company when you are under-resourced and have no scale. Plus, this step works as a great PR campaign to give your venture more exposure in the market; thus, test and possibly increase your valuation. When jumping straight to A, the ownership requirements of large funds will dictate that there is less room for other participants for the round to happen, and that fistfight for allocation will result in fewer helpful investors around the table. The first round is usually the last time one can get some really terrific folks involved, whereas most larger VC funds happily invest in the series A or B rounds of companies.

2. Maximizing Your Series A Firm

Great people are always stretching. Entrepreneurs are stretching to get the best investors in the world involved. VCs are stretching to back entrepreneurs that are a little outside of their network or are more “premium” than the brand of their own firm. Often, I see that when founders jump straight to A, it’s because a VC was stretching and the founder got one of their top choices — but not the absolutely best capital partner for their business.

Seed rounds allow you to put some wins on the board for your company, and then run a process to really maximize your series A round and the firm and person that you would want to work with.

3. Maintaining Flexibility

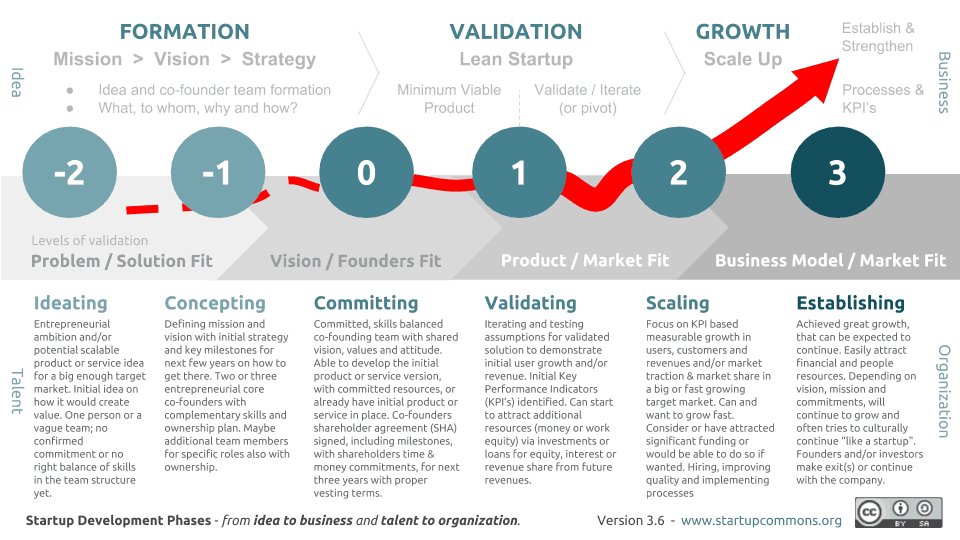

Raising a smaller amount of capital not only forces more focused experimentation and opportunity validation, it allows founders to be more flexible in the path they want to take for their business. Sometimes, founders will find that the company they thought was going to be great is actually going to be a lot harder to build, or take a lot longer, or is actually not as big of an opportunity as they thought. And if she has raised a lot of capital out of the gate, there’s greater pressure to do unnatural things to try to morph the business into something of greater scale, even at much greater risk.

A seed round allows you to be more measured about your progression and respond more flexibly to your learnings. This isn’t primarily about maintaining optionality of a smaller exit. I think it’s primarily about time. Does a founder want to take 7-10 years of her life to grind out a company towards an unnatural outcome, or would it be better to sell a company sooner, make money for investors and employees, and then give it another shot again after a few years? The small or mid-sized exit may mean a lot less for experienced founders, but getting years of their productive life back is pretty valuable for almost everyone.

4. Lowering Possible Net Dilution

It’s hard to predict total dilution over time for two different financing paths. But what I do see is that when jumping straight to A, entrepreneurs usually do need to sell a large chunk of their company to make it worth the while of a large VC to write a big check.

Usually, the dilution is in the 25% range … and certainly at least 20%. On top of that, this capital will essentially need to take a founder through the next two value accretive inflection points to be able to raise their next round at a big step up: (1) getting to product market fit and (2) building a scalable marketing machine.

That’s a pretty tall order most of the time, and if you can’t achieve both, you are going to raise your next round at flat terms or at a very small step-up to the last round.

In raising a seed round, you can minimize dilution up front due to the smaller round size, and then take these two inflection points one at a time. At each juncture, you are able to use competition to your advantage and optimize for the best terms. You will still be selling 20% of your company in most cases to your series A investor, but you may be able to raise more capital than you would have if you jumped straight to the series A.

That approach — and really all of this thinking — gives you as a founder and entrepreneur a better chance of knocking it out of the park in developing a great growth machine. So in a big upside scenario, you may achieve less total dilution after the series B, or achieve the same dilution for much more capital.

Above all else, remember: Although capital is never an end in and of itself, it is a weapon that you can use to hyper-grow your business.

Next Steps with HyperGrowthCEO

Did you enjoy the article? HyperGrowthCEO has experience in the venture capital world, developing pitch decks, and elevating entrepreneurs brands to reach maximize exposure. We are pros and engaging the exposure that is necessary to secure capital and launch your venture to new heights. Start by talking to the HyperGrowth team by booking a free marketing consult.

Consult

Stay IN Touch

Subscribe to Our Newsletter

Become a part of our community. We kick out monthly newsletters to everyone on our list. Don’t be silly. Sign up.